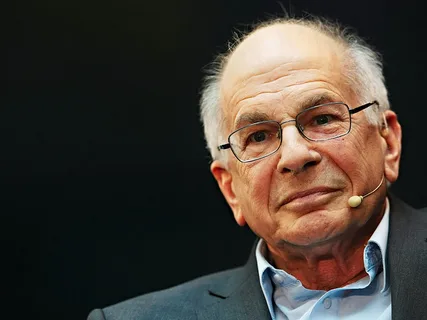

Renowned Israeli-American psychologist Daniel Kahneman, recipient of the Nobel Prize for his groundbreaking work in behavioral economics, has passed away at the age of 90. Princeton University, where Kahneman had been a faculty member since 1993, announced his peaceful demise on Wednesday. Although the cause of his death was not disclosed, Kahneman leaves behind a legacy that reshaped our understanding of human decision-making.

Daniel Kahneman: A Renowned Economist

Kahneman’s influential book, “Thinking, Fast and Slow,” challenged the conventional belief in rational decision-making, revealing instead the significant role of instinct in human behavior. His work fundamentally altered various fields within the social sciences, leaving an indelible mark on academia and beyond.

Born in Tel Aviv in 1934, Kahneman’s early years were marked by turmoil as his family fled the Nazi invasion of France during World War II. Despite the hardships, he pursued academic excellence, eventually studying math and psychology at Hebrew University in Jerusalem before earning his Ph.D. at Berkeley.

Returning to Hebrew University to teach, Kahneman forged a formidable partnership with Amos Tversky, which yielded groundbreaking research in understanding the flaws of intuitive reasoning. Their collaboration laid the foundation for modern behavioral economics, earning Kahneman the Nobel Prize in Economics in 2002, posthumously honoring Tversky, who had passed away six years prior.

The Royal Swedish Academy of Sciences recognized Kahneman’s integration of psychological insights into economic theory, particularly in elucidating human judgment and decision-making under uncertainty. As tributes pour in, Kahneman’s contributions continue to inspire scholars and practitioners alike, ensuring his enduring legacy in the annals of academia.